BTC Price Prediction: Path to $200,000 Amid Institutional Frenzy and Technical Breakout

#BTC

- Technical Momentum: MACD bullish crossover and support above lower Bollinger Band suggest continued upward potential

- Institutional Demand: Corporate accumulation nearing 1 million BTC creates structural supply shortage

- Macro Tailwinds: Federal Reserve rate cut expectations and dollar weakness concerns support Bitcoin's hedge narrative

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Consolidation Above Key Support

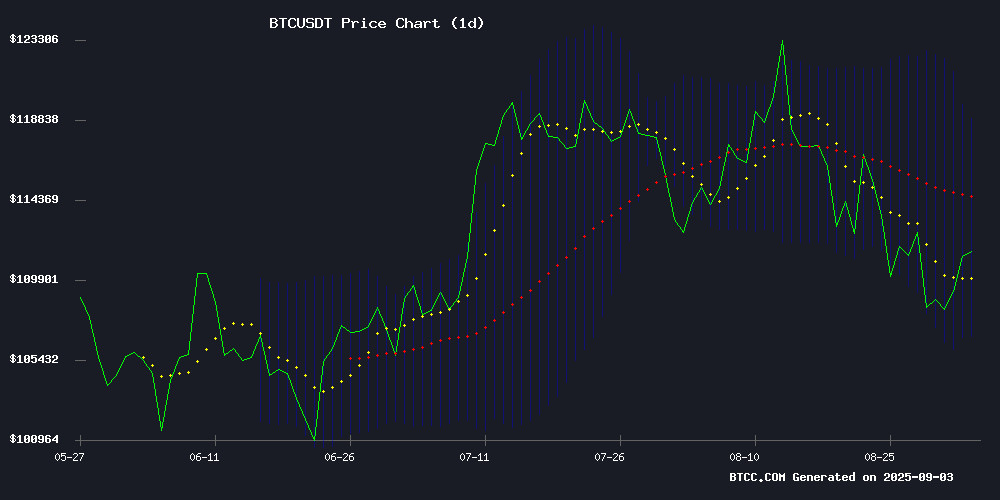

BTC is currently trading at $111,864, slightly below the 20-day moving average of $112,867, indicating a temporary consolidation phase. The MACD reading of 3546.2386 versus the signal line at 3324.3238 shows bullish momentum remains intact with a positive histogram of 221.9148. According to BTCC financial analyst James, 'The price holding above the lower Bollinger Band at $106,798 suggests strong support, while the upper band at $118,936 presents the next resistance target. This technical setup favors continued upward movement once consolidation completes.'

Market Sentiment: Institutional Accumulation Offsets Whale Profit-Taking

Despite Bitcoin whale holdings reaching their lowest level since 2018 due to profit-taking, institutional accumulation continues to accelerate with corporate holdings approaching 1 million BTC. BTCC financial analyst James notes, 'The supply tightening from institutional demand, combined with regulatory clarity allowing traditional players like US Bancorp to resume custody services, creates a fundamentally bullish backdrop. While short-term volatility persists from events like Trump-backed mining firm developments and gold's competitive performance, the structural inflows from ETF support and S&P 500 inclusion speculation provide strong underlying momentum.'

Factors Influencing BTC's Price

Bitcoin Whale Holdings Hit Lowest Since 2018 as Profit-Taking Accelerates

Bitcoin's largest investors are unwinding their positions at the fastest pace in six years. Wallets holding 100 to 10,000 BTC now average just 488 coins—levels not seen since December 2018, according to Glassnode's September 3 report.

The selloff coincides with revived activity from dormant wallets, suggesting whales are capitalizing on prices above $100,000. Long-term holders realized $3-4 billion in profits during January and July's market peaks, Checkonchain data reveals.

Despite the sustained selling pressure, Bitcoin maintains its footing near $110,000. The market's resilience highlights robust demand absorbing the whale exodus—a testament to the asset's deepening liquidity.

Trump-Backed Bitcoin Mining Firm Seeks $2.1B After Volatile Nasdaq Debut

American Bitcoin Corp. (ABTC), a mining venture partially owned by Donald Trump Jr. and Eric Trump, filed with the SEC to raise $2.1 billion through share sales. The move follows a turbulent Nasdaq debut where ABTC's stock surged 91% within an hour before plummeting below its opening price.

The stock opened at $6.90, peaked at $13.20, and triggered five trading halts before retreating. It later recovered to $8.06 in after-hours trading, marking a 16% daily gain. ABTC emerged from a merger with Gryphon Digital Mining, creating a publicly traded Bitcoin accumulation platform.

The Trump brothers hold minority stakes in the 20% not owned by Hut 8, an energy company that controls 80% of ABTC. Exact ownership details remain undisclosed. Eric Trump serves as chief strategist.

Ray Dalio Warns of Dollar Decline, Touts Bitcoin as Hedge Amid Debt Cycle Concerns

Billionaire investor Ray Dalio has doubled down on his warnings about the U.S. dollar's weakening dominance, citing the nation's unsustainable debt cycle as a catalyst for alternative assets like Bitcoin. The Bridgewater Associates founder revealed that annual debt service costs nearing $1 trillion are undermining confidence in Treasuries—a dynamic he compares to historical currency crises of the 1930s and 1970s.

"Crypto now functions as an alternative currency with programmed scarcity," Dalio noted in a published Q&A, emphasizing how monetary inflation could drive demand for limited-supply assets. His comments follow a dispute with the Financial Times over alleged misrepresentation of his views on fiat currency erosion.

The hedge fund titan specifically highlighted Bitcoin's appeal as a "hard currency" destined to outperform depreciating government money. This stance reinforces his longstanding thesis about reserve currency transitions creating tailwinds for decentralized assets.

Crypto-Linked Stocks Gain Momentum as New Listings and Index Speculation Emerge

Cryptocurrency-linked equities continue to captivate investors as fresh listings and potential index inclusions dominate market chatter. American Bitcoin (ABTC) debuted on Nasdaq following a merger with Gryphon Digital Mining, initially surging 52% before retracing to its $9.22 opening price. The volatile debut precedes Gemini's anticipated IPO, with the crypto exchange planning to offer 16.7 million shares at $17-19 apiece under ticker GEMI.

Established players Robinhood (HOOD) and MicroStrategy (MSTR) now face mounting speculation about S&P 500 inclusion. Robinhood's crypto segment expansion and recent SEC engagement signal deepening institutional commitment. Blockworks Research data reveals HOOD's 156% year-to-date performance dwarfs Coinbase's 18% gain, highlighting diverging trajectories among crypto service providers.

Lombard Raises $94.7M for Bitcoin DeFi Push with Bard Token

Lombard Finance has secured $94.7 million in a heavily oversubscribed public sale for its Bard token, far exceeding its $6.75 million target. The funds will fuel development of Bitcoin-based decentralized finance (DeFi) infrastructure through the New Liquid Bitcoin Foundation.

The 1,400% oversubscription signals strong market confidence in Bitcoin's expanding DeFi capabilities. Lombard's LBTC token - a yield-bearing Bitcoin derivative - anchors its protocol, with BARD serving as the governance mechanism. "This result shows belief in Lombard's ability to drive onchain Bitcoin demand to new highs," said co-founder Jacob Phillips, welcoming 21,340 new tokenholders.

The project joins growing institutional interest in Bitcoin DeFi, aiming to unlock the network's $1.3 trillion dormant capital. Unlike Ethereum-based alternatives, Bitcoin-native solutions like Lombard's could tap into the cryptocurrency's vast holder base while maintaining its security guarantees.

Gold Outshines Bitcoin in 2025 Rally, Challenging 'Digital Gold' Narrative

Gold has surged 32% year-to-date, doubling Bitcoin's 16% gains and reaching record highs near $3,500 per ounce. The precious metal's 100-fold appreciation since 1971 contrasts with Bitcoin's more modest trajectory, despite briefly topping $124,000 earlier this year.

Institutional demand drives gold's momentum, with central banks purchasing over 1,000 metric tons annually. SPDR Gold Trust holdings hit 977.68 tons - the highest since 2022 - as investors seek inflation hedges amid geopolitical uncertainty and anticipated Fed rate cuts.

The divergence puts pressure on Bitcoin's 'digital gold' thesis. While both assets serve as dollar alternatives, gold's lower volatility and entrenched reserve status continue attracting risk-averse capital. Market watchers note this marks the third multi-year period where bullion has outperformed crypto's flagship asset.

Bitcoin Bulls Flex as BTC Reclaims $112K — Fed Cut Looms, Gold Soars

Bitcoin has surged back to the $112,000 range after a brief dip to $107,270 earlier this week. Exchange order books revealed significant ask liquidity at this level, with BTC's rebound absorbing some of it before stalling below $114,000. Short-sellers faced liquidations as open interest and leverage reset.

The rally comes ahead of an anticipated Federal Reserve rate cut on September 17, with markets pricing in a 95% probability. Easier monetary policy typically fuels risk assets, and Bitcoin is increasingly positioned as the premier speculative hedge. QCP Capital notes a favorable macro environment for BTC, where potential inflation pressures could weaken the U.S. dollar — benefiting hard assets like Bitcoin and gold.

Gold has reached record highs at $3,567 per ounce, reinforcing its status as a traditional hedge. Bitcoin now shares this narrative as both assets thrive amid central bank uncertainty. The key distinction lies in Bitcoin's digital scarcity versus gold's physical legacy.

Institutional Bitcoin Accumulation Accelerates Despite Market Correction

Corporate treasury strategies for Bitcoin are growing increasingly sophisticated as institutional adoption reaches unprecedented levels. The top 100 publicly traded companies now collectively hold 990,695 BTC worth $108 billion - nearing the symbolic one million BTC threshold. This sustained accumulation occurs despite recent price volatility, signaling deepening conviction in Bitcoin's role as a treasury asset.

Last week's notable acquisitions include Strategy (3,081 BTC), Metaplanet (1,009 BTC), and Boyaa Interactive (290 BTC), with the top five purchases alone exceeding Bitcoin's weekly new supply of 3,150 coins. The institutional rush has expanded beyond public companies to include private entities like Tether and Block, plus national treasuries - collectively representing over 3.68 million BTC held by 310+ entities.

The launch of spot Bitcoin ETFs has catalyzed this movement, transforming Bitcoin from a speculative asset to a mainstream treasury holding. Corporate strategies now employ sophisticated instruments including convertible bonds and preferred shares, marking a maturation beyond simple one-time allocations.

MicroStrategy Stock Eyes 40% Upside on S&P 500 Inclusion Hopes Amid Bitcoin Rally

MicroStrategy shares gained 2.16% to $341, extending six-month gains to 36%, as traders anticipate potential S&P 500 inclusion. The decision, expected Friday, could trigger billions in institutional demand as index funds rebalance.

Bitcoin's performance remains pivotal. Technical charts suggest a 40% upside to $480 if momentum holds, though failure to maintain support could see a retreat to $300. The stock's fortunes remain tethered to crypto markets - its $8 billion Bitcoin treasury now represents 150% of its market cap.

Market participants note the unusual dynamic: MicroStrategy has effectively become a leveraged Bitcoin ETF. Its S&P eligibility stems from traditional financial metrics, yet valuation swings increasingly mirror crypto volatility rather than enterprise software fundamentals.

Corporate Accumulation Nears 1M BTC: Institutional Demand Tightens Bitcoin Supply

Institutional and corporate Bitcoin holdings are approaching a symbolic milestone, with 995,031 BTC now held on balance sheets—just 4,969 BTC shy of 1 million. The past week alone saw 6,760 BTC added to corporate treasuries, accelerating the supply squeeze in an asset already hard-capped at 21 million coins.

MicroStrategy and Galaxy Digital lead this accumulation trend, treating Bitcoin as a core reserve asset. The top 100 institutional holders now control nearly 5% of circulating supply, creating scarcity conditions that amplify price impact from marginal buys. Public filings reveal 228 institutions disclosed BTC holdings in 2025, signaling mainstream adoption.

Technically, Bitcoin shows resilience after defending its 200-day EMA ($104,044) and reclaiming the 7-day SMA ($109,953). The RSI-14 rebound from 43 to 45.5 suggests weakening bearish momentum, though sustained institutional accumulation remains the dominant market narrative.

US Bancorp Resumes Bitcoin Custody Services with ETF Support Amid Regulatory Clarity

US Bancorp has reinstated its Bitcoin custody services for institutional clients, marking a strategic reversal after suspending the offering in late 2022 due to regulatory uncertainty. The Minneapolis-based bank, the fifth-largest commercial lender in the US, will now also custody spot bitcoin ETFs—a service enabled by recent SEC approvals and clearer federal guidelines for banks acting as digital asset custodians.

BlackRock's iShares Bitcoin Trust (IBIT) leads ETF inflows with $58.4 billion in assets, reflecting institutional demand for regulated crypto exposure. The move signals a broader thaw in crypto banking relations, underscored by the SEC's rollback of restrictive accounting policies like SAB 121.

Will BTC Price Hit 200000?

Based on current technical indicators and market fundamentals, reaching $200,000 represents a plausible but aggressive target that would require sustained institutional momentum and favorable macroeconomic conditions. The current price of $111,864 would need approximately a 79% increase from current levels.

| Key Levels | Price (USDT) | Significance |

|---|---|---|

| Current Price | 111,864 | Consolidation below 20-day MA |

| Immediate Resistance | 118,936 | Upper Bollinger Band |

| Major Support | 106,798 | Lower Bollinger Band |

| Target 1 | 150,000 | 34% increase required |

| Target 2 (200K) | 200,000 | 79% increase required |

BTCC financial analyst James suggests that 'While the $200,000 milestone is achievable within the current market cycle, it would require continued institutional adoption, supportive Fed policy, and maintained supply tightness. The accelerating corporate accumulation and potential S&P 500 inclusion catalysts provide credible pathways to this target, though timing remains uncertain given market volatility.'